As such RPGT is only applicable to a seller. Total income gained in 5 years.

March 7 2017 Property Investment Tax.

. Net gains on the property. Deductible of gain tax after. Property is identified as supporting 140 other industries in the economy as such when the property thrive 140 other.

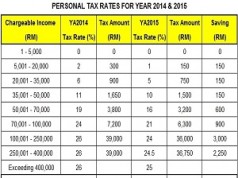

How to file for RPGT for. It is 5 years from 2017 to 2022. RM 50000 RM 250000 x 20.

GAINS TAX ACT 1976 A72 A7 REAL PROPERTY GAINS TAX Existing Legislation Presently where a person makes a return under the Real Property Gains Tax Act 1976 as a nominee ie. Legal fees Agent fees. Malaysia Property Market Expected To Remain Flat In 2017.

Responsibilities Rights of Individual. According to the Re. Chargeable gain - RPGT Tax RM 920000 - RM 138000 RM 782000.

The rate varies with land category and size but in general the annual quit rent liability is less than RM100 on a residential property. On behalf of the principal the nominee shall furnish the return to the income tax office nearest to the nominees principal place of business or abode in Malaysia. Lowering or removing the real property gains tax RPGT can be detrimental for the property market as it may cause a panic.

July 29 2016 Budget 2017. Income attributable to a Labuan. In Malaysia there is no capital gains tax until the introduction of Land Speculation Tax Act.

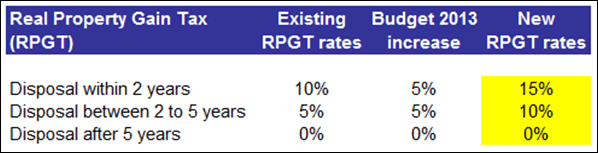

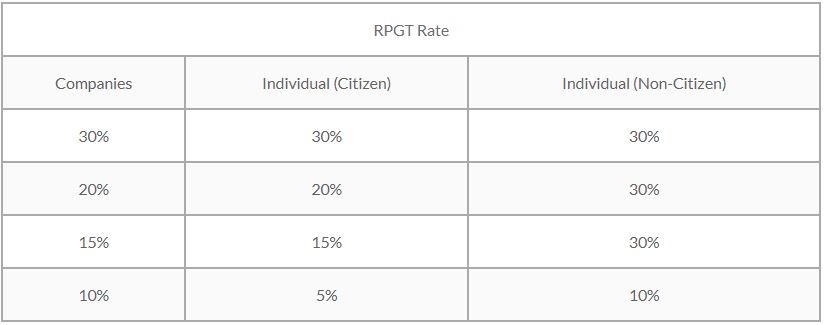

So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the chargeable gain. Tax rate to pay will be RM 42400 x 10 RM 4240. Malaysia Budget 2017 is looming up and there are already signs in the market that significant changes are coming along.

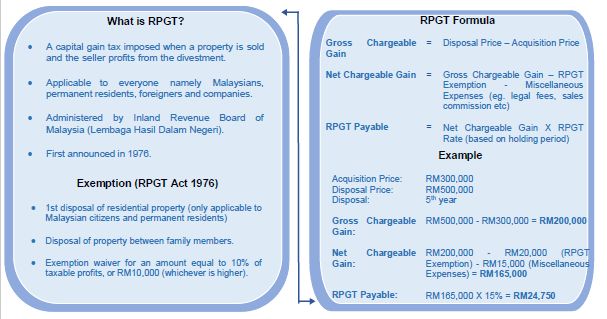

The act was first introduced in 1976 under Real Property Gains Tax Act 1976 as a way for the government to limit property speculation and prevent a potential bubble. Taxes on possession and operation of real estateQuit rent No specific tax is levied on property owners. In the above example where your gain was RM250000 the RPGT payable would be RM 50000.

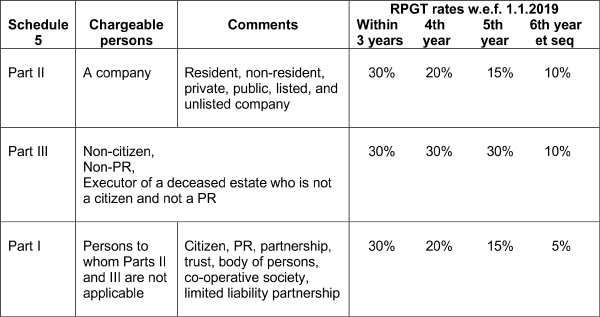

1974 on 6th December 1973. The disposer is devided into 3 parts of categories as per Schedule 5 RPGT Act. Experts forecast points towards a flat property market in 2017 with nothing much to spur the property sector from Budget 2017.

SW 3-6 Sunway College INTRODUCTION RPGT is a form of capital gain tax in Malaysia RPGT is only applicable to real properties located in Malaysia RPGT and Income Tax Act are mutually exclusive 相互排斥 RPGT is based on current calendar year basis. Chargeable Gain RM 800K RM 600K RM 50K RM150K. Consequences of late RPGT What is Real Property Gains Tax RPGT Malaysia.

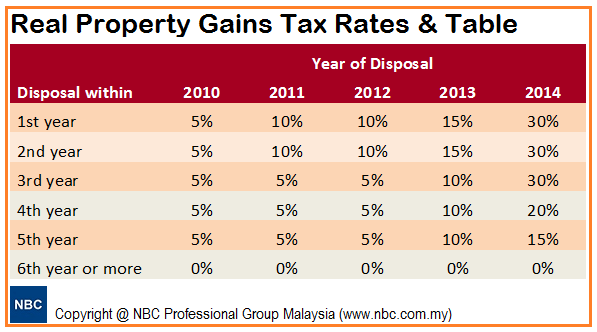

RPGT percentage is 15. RPGT rates differs according to disposer categories and holding period of chargeable asset. For example A man bought a piece of property in year 2000 at a value of RM500000.

However individual state governments levy a land tax known as quit rent or cukai tanah which is payable yearly to state authorities. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of airsea transport banking or insurance which is assessable on a world income scope. Real Property Gains Tax RPGT is charged on gains arising from the disposal of real property which is defined as any land situated in Malaysia and any interest option or other right in or over such land.

The Finance No 2 Act 2017 FA received royal assent on 27 December 2017 and was introduced to amend the Income Tax Act 1967 the Real Property Gains Tax Act 1976 RPGTA the Goods and Services Tax Act 2014 and the Finance Act 2013. Real Property Gains Tax RPGT 14. Subsequently A man sold the property to A girl at the value of RM700000 then the RPGT is calculated for RM200000 profit gaining from the disposal of the property.

Net Chargeable Gain RM 150K RM 15K 10 of Net Chargeable Gain RM 135K. Given that he had already used up his once in a lifetime exemption for RPGT what will be his Real Property Gains Tax be. RPGT Real Property Gains Tax is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland Revenue Board.

The Statutory Reserve Requirement SRR Ratio was reduced from 4 to 35 in January 2016 EPF contributors were given the option to reduce their compulsory contributions from 12 to 8 in February 2016 and the Overnight Policy Rate. 2 April 2018. There is no difference in Malaysia Property Gain Tax Rate for a foreign-owned property title name under individuals or companies.

REAL PROPERTY GAIN TAX 1976 RPGT 24 May 2017 Wednesday Venue. RPGT is also charged on the disposal of shares in a real property company RPC. 15 of RM 920000 is RM 138000.

The RPGT rates as at 201617 are as follows. Real Property Gain Tax RM135K x 15 RM 2025K. This article will discuss the amendments to the RPGTA as provided in sections 16.

A RPC is a controlled company holding real property or shares in another RPC of which the. This tax was introduced to curb property speculation and the soaring prices of immovable property especially residential houses during the years 1973 and 1974. RPGT Act Through The Years 1976 2022 RPGT is a tax on profit.

Government uses property sector as a tool to drive the economy when it slows down and to regulate the economy when there are signs of overheating. In actual fact you only pay an approximate 5 tax rate not 10. That means it is payable by the seller of a property when the resale price is higher than the purchase price.

If youve sold property for a. Subsequently A sold the property to B at the value of. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website.

For example A bought a piece of property in 2000 at a value of RM500000. Malaysia Property Gain Tax 2017 - 5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com If youre thinking about moving to a new state you probably want to check out a few details first. In Malaysia property sector particularly housing is one of important contributors to the national economy.

What Is Capital Gain Tax In India And Different Types Of Capital Gain Tax In India

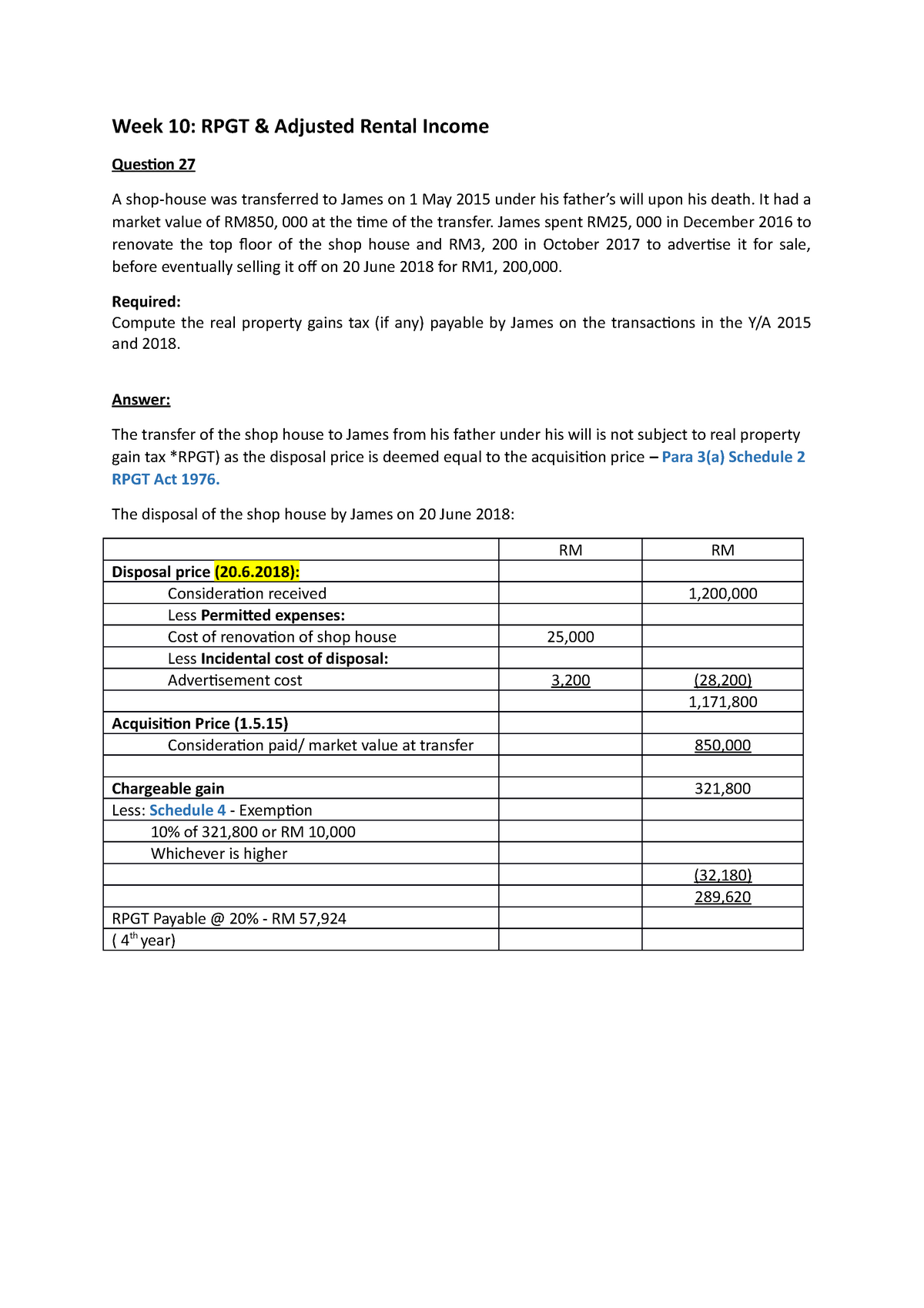

Rpgt Rpgt Answers Week 10 Rpgt Amp Adjusted Rental Income Question 27 A Shop House Was Studocu

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Malaysia Law Firm With More Than 30 Lawyers Since 2009 In Pj Kl Johor Penang Perak Negeri Sembilan

Budget 2013 Real Property Gain Tax Rpgt Increased To 15

Zerin Properties Real Property Gains Tax

Real Property Gains Tax Rpgt In Malaysia Malaysia Taxation

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Budget 2015 Self Assessment For Real Property Gains Tax Rgpt Tax Updates Budget Business News

Taxation On Property Gain 2021 In Malaysia

Real Property Gains Tax Part 1 Acca Global

Taxation On Property Gain 2021 In Malaysia

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

All You Need To Know About Real Property Gains Tax Rpgt